E-invoicing in the ASEAN region: current state and future developments

The process of the electronic invoicing implementation in Asia is currently in its initial phase. The lack of government actions, tax constraints, established standards, regulatory framework and a correct understanding of the system are some of the issues hindering the e-invoicing development in the countries of this area, as well as the usage of modern e-invoicing solutions. Asian governments decided to gradually introduce mandatory e-Invoicing regulations based on an invoicing volume of businesses. The most visible speed in this field concerns the part of Asia called ASEAN (Association of South East Asian Nations).

ASEAN consist of few countries such as: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam, and its aim is to contribute to the economic, social and cultural development of South East Asia and ensure the stability of the entire region. Let’s take a closer look at how e-Invoicing situation develops in this area and what is yet to come.

Electronic invoicing in ASEAN – facts and news

Some of the ASEAN countries have already introduced mandate e-invoicing. Now in total the obligation concerns two countries while the other five are planning to introduce it in the nearest time.

Countries with current e-Invoicing obligations

Singapore

Singapore is one of the first countries that have introduced e-Invoicing in the ASEAN. The obligation is active since 2018, which has become mandatory for government authorities based on the PEPPOL interoperability framework. The main reason for such action was to improve business efficiency, reduce costs, improve the process of payment cycles and lay a good basis for progressive digitization. Since Singapore was one of the pioneers, it also determined to be a home for various organizations connected to e-Invoicing. For example, since 2018, IMDA (Info-Communications Media Development Authority) – the first PEPPOL authority outside the European community is placed there. It is responsible for approving and certifying Access Point Providers (APPs) and is also responsible for regulating national standards and specifications according to the requirements.

Indonesia

The Indonesian government introduced e-Faktur Pajak, implemented by the DGT (Director General of Taxation), and made it mandatory in 2016 for companies to use e-invoices, in order to guarantee that the enforcement authority is properly notified. The main goal of the Indonesian government has been to prevent tax fraud, while also improving the trade. To help resolve this issue, the government has implemented an electronic invoicing system, based on a clearance model, where all invoices issued must be approved by the tax authority before being sent to the customer.

Countries where e-Invoicing obligations are soon to be implemented

Thailand

In 2016, Thai government has introduced a new policy “Thailand 4.0”, which includes two main long-term objectives: to transform Thailand into a Digital Economy and to become by 2032 the advanced economy nation. To achieve those objectives, wide promotion of e-Invoicing (which is still not mandatory) will be necessary there. Despite the lack of obligation, it is already possible for VAT-parties to send e-invoices and receipts on voluntary basis using e-Tax system (which is dedicated for e-Invoicing).

For the preparation and storage of e-tax invoices and receipts, the applicant must comply with the regulations (such as security of data, protection of audit trails, control of user access levels, and passwords) from the Revenue Department (RD). What is mor,e e-Invoices should include two digital signatures, a certificate issued by RD and the certificate number. This number is provided and approved by the tax authority (RD).

The e-documents ( i.e. invoices, credit notes, debit notes) are required to include certain information such as the amount of VAT, name and address of a client and the purchase cost of the goods or services. This data has to be exported and transmitted to the Thai tax authority every month. The e-Tax solution can create files in XML format for submission to the Revenue Department and automatically deliver them to the buyer or the service recipient.

Philipines (updated)

Philippine Digital Transformation Strategy 2022 describes a plan for the Philippine government to achieve digital transformation and launch a new e-government system by 2022.

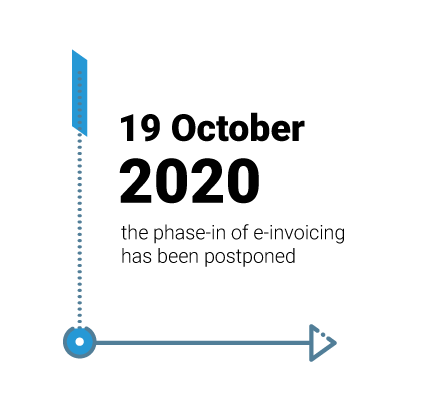

The Department of Finance (DOF) announced a new timeline for the go-live of the Philippine e-invoicing system (EIS).

The launch of pilot program for e-Invoicing has been postponed with six months, from January to July 2022.

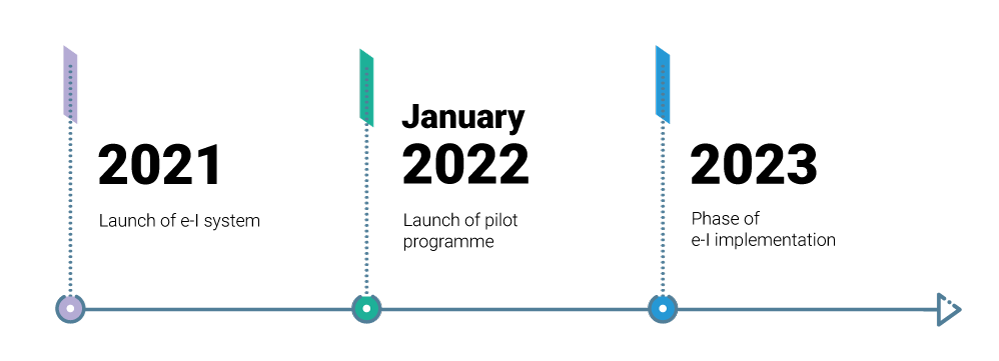

Timeline:

The Department of Finance (DOF) expects then to launch a pilot program for e-Invoicing in July 2022, based on the South Korea model. After the launch of the pilot program, the Department of Finance is planning to implement e-Invoicing in 2023 through a gradual phasing-in. It would start with B2B transactions of large payers and exporters.

Electronic invoicing will be mandatory for VAT-registered businesses and such companies will be required to submit invoices to the tax authorities via different ways among which you can find:

- uploading e-invoices via web portal,

- using a certified service provider,

- generating e-invoices through an own accounting system including a digital certificate,

- submitting in person at a local tax office.

Vietnam

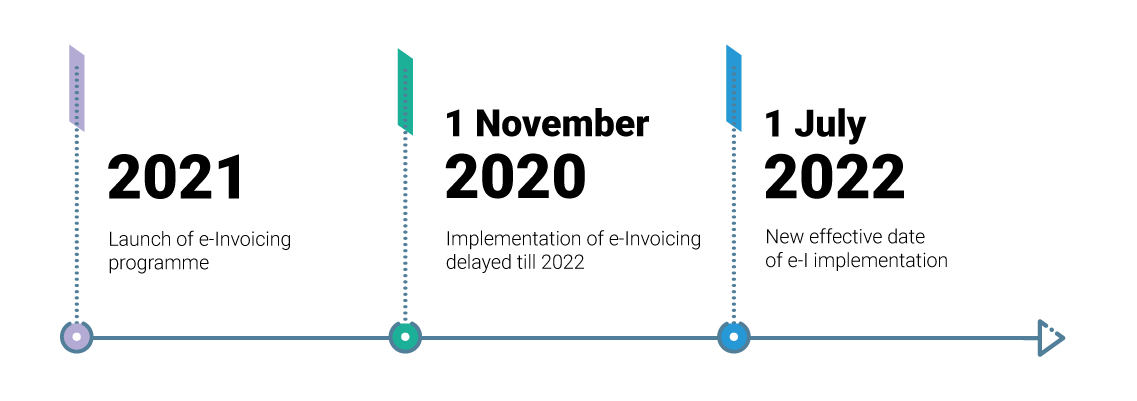

Another country where e-Invoicing will be mandatory for all corporations is Vietnam, where the implementation has been postponed until July 2022. The General Department of Taxation (GDT) encourages businesses that are ready to switch to e-invoicing, to apply early and start the implementation process. Several regulations have been issued, including technical and infrastructure regulations, like Circular No. 68/2019 / TT-BTC, issued by the Ministry of Finance, which sets out the guidelines for the development of e-Invoicing implementation under Decree 119.

Timeline :

The e-document (i.e. invoices, credit notes, debit notes) format is based on the XML format and must include the e-Invoice data and the digital signature. Businesses will be required to transmit the data for e-Invoices issued to tax authorities either directly or via a certified service provider.

Malaysia and Brunei

Elsewhere in the ASEAN region, Malaysia and Brunei are also implementing e-invoicing systems, have either adopted or are considering PEPPOL network as their e-Invoicing standard as it will facilitate interoperability in cross-border business processes.

Key advantages of e-Invoicing solutions

The global movement towards e-Invoicing is not a coincidence. What are the benefits that are attracting the interest of a growing number of businesses and government authorities not only in the ASEAN region but also around the world? Here is a list of some of them:

- Saving time: the creation, sending and archiving processes is made much easier.

- Saving money: no more postage and printing of documents.

- Saving space: with digital archiving, the well-known folders disappear.

- Secure archiving: with a valid e-Invoicing software, it is possible to easily store and manage all invoices – both sent and received -for the legally required retention period.

- Simplicity and ease of use: a good e-Invoicing system is straightforward and offers continuous support.

- Security in data management: sensitive data is protected by the Interchange System which collects and monitors data sent and received.

- Usability: the e-Invoicing system can be used over the network, allowing to create e-Invoices wherever the user wants to do it.

- Tax reductions: the state always provides for more tax relief.

- Simplified tax controls: thanks to electronic storage and indexing, it is easy to find and consult invoices at any time.

- Traceability of movements and payments: the use of electronic invoicing makes it possible to monitor the sending and receipt of documents and to keep track of payments.

Conclusive remarks

Currently it is not easy to determine the position of e-Invoicing in Asia, and we will see how its implementation evolves in this very large and diverse territory. Anyhow, the use of e-invoicing there, may end up being normalized – both to improve control and to speed up business transactions, reminding companies that the invoice is at the end of every business process which if digitized in whole or in part, can be more efficient and faster, thus saving time and money.

However, this does not only mean adopting an innovative way of exchanging tax documents, but rather building a different working environment in which practices and procedures have to be changed.

About the Author

Vincenzo Cirillo

Business Solutions Manager, Comarch