Mandatory Electronic Invoicing in Singapore

Learn how to get your company ready to exchange documents in accordance with regulations in Singapore with the support of Comarch

Learn how to get your company ready to exchange documents in accordance with regulations in Singapore with the support of Comarch

Singapore was one of the pioneers in the field of e-invoicing in the ASEAN region and introduced the obligation to use electronic document exchange in 2018. Since then, it has been a rule in B2G relations that government authorities exchange e-invoices with private companies via Peppol network.

The Infocomm Media Development Authority (IMDA) established in 2019, which was the first accredited Peppol Authority operating outside Europe, intends to digitize and promote electronic invoicing in Singapore. In order to reduce errors, time spent processing invoices and payments, IMDA has created a nationwide network for e-invoicing - InvocieNow and promotes the adoption of electronic invoicing in the private sector.

E-invoicing for B2B is not mandatory in Singapore at any level. However, it is strongly recommended by IMDA.

E-invoices are exchanged based on the PEPPOL interoperability framework. Accepted format is Peppol BIS Billing 3.0.

Required storage period is 5 years.

Integrity and authenticity must be ensured. An Advanced Electronic Signature can be used to meet these requirements.

Comarch is currently participating in the certification process to become the authorisied Peppol Service Provider in Singapore.

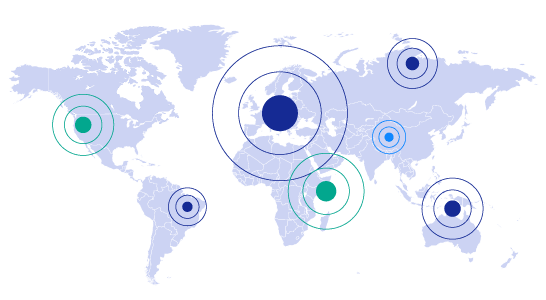

We have 20+ years of experience in carrying out various EDI, e-invoicing, and other document exchange projects around the world. In those years, we have successfully connected more than 130,000 entities from over 60 countries.

Full compliance with the latest data exchange regulations and modern data transfer standards

Applying new technologies and IT solutions in order to streamline workflows and automate activities and procedures

Tailor-made solutions based on processes specific to each company – own road map and a suitable pace of changes

Highest level of security for all sensitive and important company data

If your company is based or has branches in the CountryName and you need to prepare your billing and tax systems to comply with the new requirements. Click on the button below to get in touch with one of our experts.