Mandatory B2B E-invoicing in France – When and How?Check what changes are coming soon to France, and how Comarch can help

Mandatory B2B E-invoicing in France – When and How?Check what changes are coming soon to France, and how Comarch can help

Since January 1st 2020, companies have been required to send their invoices to the public sector in electronic format. In the near future, the mandatory handling of electronic invoices in B2B relations will also become a fact. The purpose of this change is to simplify business life and increase competitiveness by reducing administrative burdens, shortening payment times, increasing efficiency resulting from dematerialization, and simplifying VAT reporting obligations.

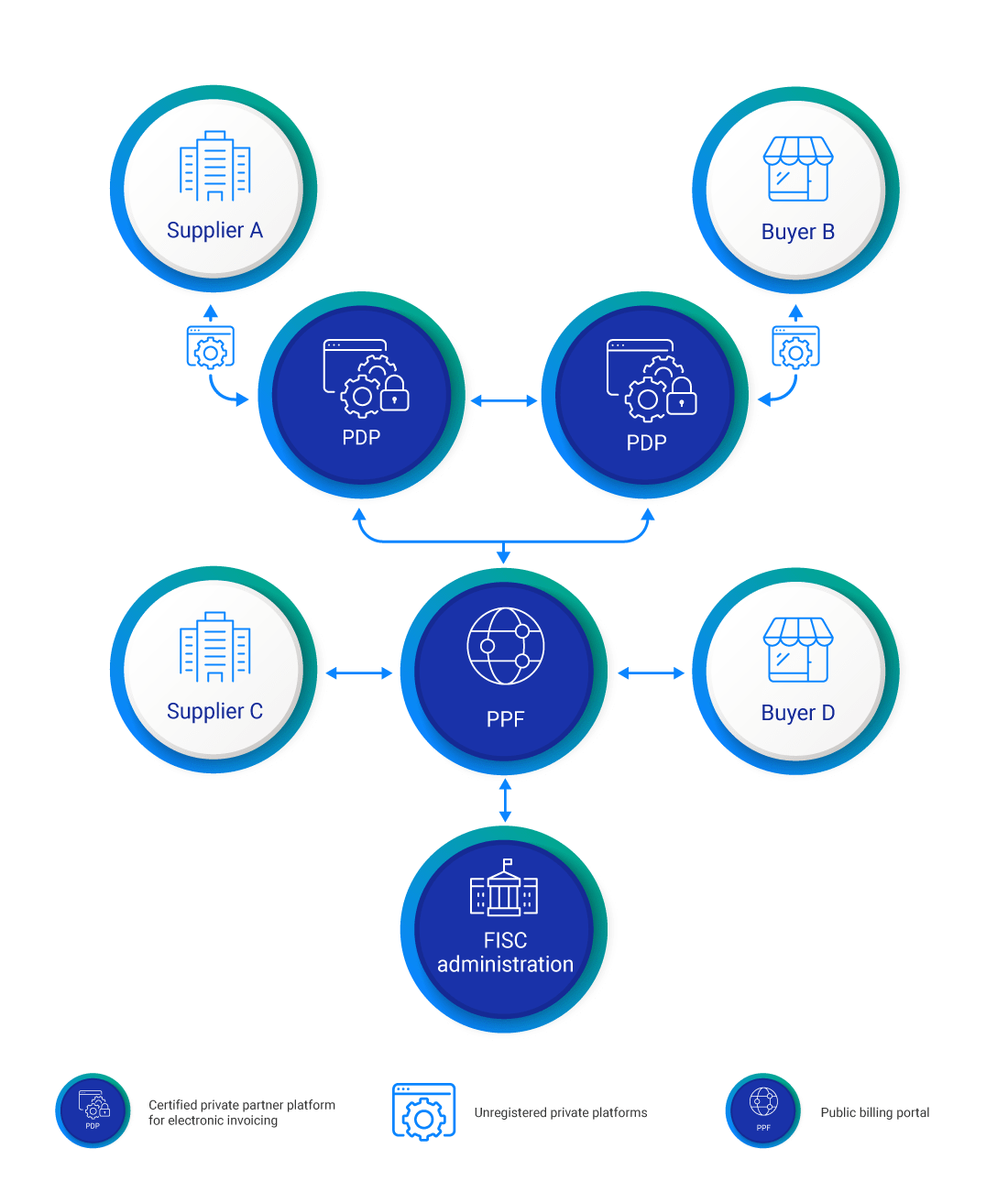

After the entry into force of the reform, all taxpayers will have to be able to receive electronic invoices, while the obligation to issue electronic invoices will be implemented in stages, starting with large companies. Ultimately, all entrepreneurs will have to be able to issue electronic invoices. The situation in France is interesting as regards the model in which the exchange of e-invoices will be implemented. If the taxpayer connects directly to the government platform (PPF), then this form of invoice exchange can be referred to as centralized CTC. However, if invoices are exchanged through a certified supplier (PDP), we will be dealing with a decentralized CTC model.

The reform will concern:

In addition, it is planned to introduce e-reporting, i.e. providing tax authorities with additional data in the case of international B2B transactions and transactions between enterprises and end consumers, along with the transmission of transaction payment data.

France is gradually implementing electronic invoicing, starting with the B2G e-invoicing obligation that came into force in 2020 and the requirement for companies to send invoices to the public sector in electronic form. A gradual transition to mandatory B2B e-invoicing is also planned, which will gradually cover enterprises of all sizes.

On July 28, 2023, the French government announced a delay in implementing mandatory B2B e-invoicing and e-reporting, originally planned for July 1, 2024.

On October 17th, 2023, France’s lower house of Parliament, the Assemblée Nationale, introduced an amendment to the upcoming budgetary bill instituting a new realistic timeline for bringing the e-invoicing and e-reporting system into life.

The new e-invoicing implementation timeline will be as follows:

Maintaining such a schedule means France must apply for an extension of the European Commission’s VAT derogation directive, as the current permission to introduce the planned system is valid only until the end of 2026.

Comarch is working towards certification and becoming a Registered Private Platform (PDP) to ensure that our solutions will be ready for implementation when the billing model becomes mandatory. Comarch applied for certification under the "Facturation électronique - required d'immatriculation pour" on October 13, 2023. [APPLICATION]

Comarch regularly participates in all workshops devoted to legislative changes in e-invoicing in France to be up to date with all plans. Comarch has also joined the National Forum of e-Invoicing in France to be one of the best-informed providers.

Comarch will transfer the invoice as a registered platform in a dematerialized format from the supplier directly to the customer. At the same time, it will extract specific data from these invoices and provide them to the tax authority (e.g., supplier and recipient identification, transaction amount excluding VAT, VAT amount due, etc.). Acting as an intermediary between the supplier and the customer, Comarch will be able to convert the supplier's invoice format into a format that suits his customer. This will be carried out under conditions that will ensure, in particular, the data's integrity, authenticity, and completeness.

Issuing, sending and receiving electronic invoices in France will be carried out by:

Data for invoices issued by taxpayers using the public invoicing portal will be provided directly to the tax authority. Invoicing data issued by taxpayers using PDP services are transferred by its operator to the public portal, which in turn forwards them to the tax authority. Thus, when using PDP services, data is sent via an entity that, after being registered by the tax authority, has the authority to send invoices directly to the recipient. An invoice in PDF format (scanned invoice or PDF file generated from an office tool) sent by e-mail will not be treated as an e-invoice in the new system, therefore it will no longer be possible to send invoices directly to customers or by e-mail.

Data sealed with a qualified electronic seal enjoy the presumption of integrity and authenticity.

The invoices are to be issued in the formats of UBL, CII, or Factur-X.

B2G and B2B e-invoicing are to be performed through the B2G platform Chorus Pro, which is already being used.

Required storage period is 10+1 years.

Want a practical overview of mandatory e‑invoicing & e‑reporting in France? Get a free copy of our latest white paper.

Ready to exchange invoices in accordance with the legal framework for e-invoicing set out in Regulation no. 2021-1190 of September 15, 2021 on the extension of e-invoicing to all transactions between entities subject to VAT?

Thanks to Comarch EDI:

Ready to be compliant with required UBL, CII, or Factur-X formats and monitor any interruptions in the availability of the platform?

Thanks to Comarch EDI:

Ready for full control over all documents exchanged with government platform?

Thanks to Comarch EDI Tracking and Archive:

Easy and instant access to the status of all documents sent to the government platform

Full insight into all incorrect documents with detailed information about the type of errors and the reason for their occurrence

Presentation of archived invoices in a structured, readable form for the period required by law

Ready to provide technical support to ensure that all requirements are met?

Thanks to the cooperation with Comarch:

We have 20+ years of experience in carrying out various EDI, e-invoicing, and other document exchange projects around the world. In those years, we have successfully connected more than 130,000 entities from over 60 countries.

Full compliance with the latest data exchange regulations and modern data transfer standards

Applying new technologies and IT solutions in order to streamline workflows and automate activities and procedures

Tailor-made solutions based on processes specific to each company – own road map and a suitable pace of changes

Highest level of security for all sensitive and important company data

The implementation of mandatory B2B e-invoicing and e-reporting has been postponed, and the new implementation date will be set as part of the work on the adoption of the budget act for 2024.

The invoices are to be issued in the formats of UBL, CII, or Factur-X.

B2G and B2B e-invoicing are to be performed through the B2G platform Chorus Pro, which is already being used.

Issuing, sending and receiving electronic invoices in France will be carried out by:

Data sealed with a qualified electronic seal enjoy the presumption of integrity and authenticity.

Required storage period is 10+1 years.

Chorus Pro is a public invoicing portal (PPF) for sending structured invoices to the tax authorities in France. For now, it is being used for B2G transactions and soon will be also used for B2B ones.

For now, only B2G e-invoicing is valid in France. For B2B transactions, its implementation was planned for July 1, 2024, while on July 28, 2023, the French government announced a delay.

Generally, the obligation will affect all sized companies – large, medium and small (each year introducing the obligation for a specific size of companies). In 2024, all companies will be able to take part as volunteers in a pilot phase.

The trusted partner needs to be certified as PDP (Plateforme de Dématérialisation Partenaire). Their role will be to act as a trusted third party and transform, validate and send invoices to the French tax authority.

A good provider should also have experience in providing similar services in other countries, so you are sure they are exchanging your sensitive data securely, reliably and most of all in line with governments’ requirements.

The best solution needs to be in line with French requirements, so make sure the provider understands and is compliant with all requirements (for example, that they can technically serve the required format factur X).