Mandatory E-invoicing in Belgium

Learn how to get your company ready to exchange documents in accordance with regulations in Belgium

Learn how to get your company ready to exchange documents in accordance with regulations in Belgium

Belgium has already introduced mandatory e-invoicing for B2G transactions. The Ministry of Finance does not intend to stop there, and Belgium will start partially introducing mandatory B2B e-invoicing from July 2026.

All Belgian public bodies are already obliged to be able to receive and process electronic invoices in the context of public procurement, which makes it mandatory for all federal government suppliers to issue electronic invoices (transposition of Directive 2014/55/EU). This obligation applies to contracts above EUR 30,000, and from October 2023 it will also cover contracts below this amount. Invoices below EUR 3,000 are exempt.

In Belgium, measures to reform the tax system, including the invoice exchange model and the transition to electronic invoicing, have just started. The Belgian Ministry of Finance has announced that the reforms will focus on electronic invoicing in the private sector in B2B transactions. To make this possible, all companies have been registered on the Hermes platform, which will enable e-invoices to be sent in B2B relations. Currently, B2B e-invoicing is possible provided that the seller and the buyer agree to it.

The main focus will be on reporting data from invoices, and the goal of mandatory e-invoicing will be achieved in stages. PEPPOL is likely to be the preferred standard for e-invoicing, which will include near-live e-reports to replace the annual customer inventory report.

Due to the legislative impasse around comprehensive tax reforms in Belgium and given the complexity of the Belgian legal framework, the implementation of e-invoicing was postponed.

After a revision, the mandate will be introduced in stages, with the first starting in January 2026. The exact criteria for entities falling under each stage are not yet known. However, based on the previous timeline’s introduction schedule, it is safe to assume the initial phase will encompass only the largest entities (turnover above €9 million), with medium (turnover between €7m and €9m) and small ones (below €7m) following in subsequent months.

Eventually, a B2C reporting requirement is also planned, along with further expansion of reporting requirements in the years following the introduction of the e-invoicing mandate.

Belgian authorities aim to base their e-invoicing landscape on the Peppol network already used in B2G transactions. Nowadays, joining the network is also through a publicly offered “Hermes” platform, allowing for receiving and converting the invoices or via an authorized PEPPOL services provider. However, the platform is scheduled to go out of commission in the years following the mandate’s introduction, so finding an authorized e-invoicing partner may be critically necessary.

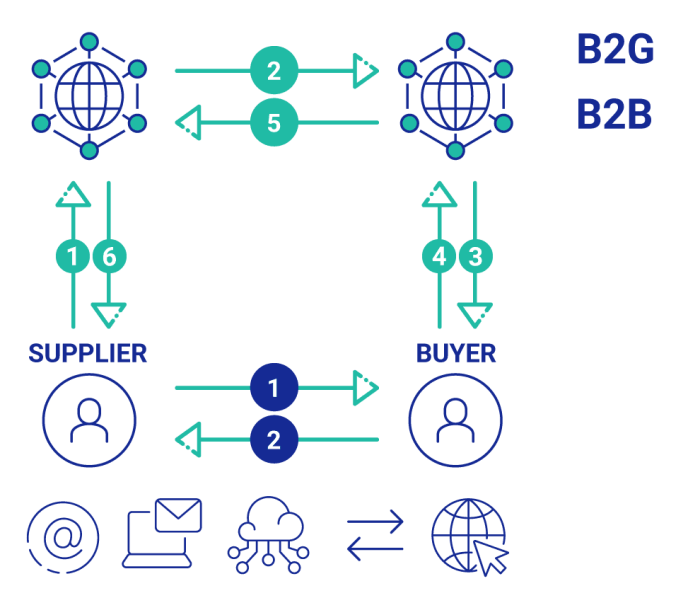

Suppliers of the public sector have two options to submit their invoices:

B2G invoices are to be submitted through the Mercurius platform. This platform was developed by the Belgian government, and is connected to the PEPPOL network. Invoices and credit notes exchanged via the Mercurius platform have to be compliant with the PEPPOL BIS 3.0 document format.

Mercurius facilitates the integration of systems between senders and recipients. It is equipped with an online portal that is accessible to all Belgian organizations and provides tracking services for senders, recipients and their service providers. The portal also allows manual upload of invoices. Mercurius is fully and exclusively aligned with PEPPOL. The platform can also convert uploaded documents from a machine readable format (XML) to a human readable format (PDF).

Comarch is a certified PEPPOL access point. Under the four-corner PEPPOL model, the buyer and supplier exchange invoices via an access point, which is a PEPPOL certified service provider that ensures data security and compliance with PEPPOL standards (for example, UBL format or AS4 communication protocol).

We have 20+ years of experience in carrying out various EDI, e-invoicing, and other document exchange projects around the world. In those years, we have successfully connected more than 130,000 entities from over 60 countries.

Full compliance with the latest data exchange regulations and modern data transfer standards

Applying new technologies and IT solutions in order to streamline workflows and automate activities and procedures

Tailor-made solutions based on processes specific to each company – own road map and a suitable pace of changes

Highest level of security for all sensitive and important company data