Comarch NonLife InsuranceMulti-module policy administration solution to satisfy all insurer’s needs, ensuring

Comarch NonLife InsuranceMulti-module policy administration solution to satisfy all insurer’s needs, ensuring

high quality customer service

Multi-module policy administration solution to satisfy all insurer’s needs, ensuring high quality customer service, dedicated to all types of property and casualty insurance.

The Comarch NonLife Insurance solution is dedicated to all insurance companies offering property and casualty insurance (general insurance). Our system handles individual and group products offered to the retail and corporate customers alike. Comarch NonLife Insurance is valued both by insurers offering a traditional portfolio of insurance products and those who specialize in bancassurance or selected niche risks. The system's modular structure greatly facilitates its extension with new components as well as integration with the insurer’s existing software. This core insurance system is enhanced with a user-friendly web portal for front-office operations.

Comprehensive management of all, even the most complex product lines in one policy administration system

Fast product modification and new product introduction to the non-life insurance market

Easy integration and expansion of core insurance system, thanks to the modular approach and Service-Oriented Architecture

Based on the workflow engine with task inboxes, managed by power business users

Comarch NonLife Insurance supports the following business processes:

Owing to its flexibility and parameterization abilities the Product Management module allows for:

This approach significantly reduces the time needed to implement a new product in Comarch NonLife Insurance system by the insurer without at system provider support.

The Finance & Accounting module is a complementary module of the Comarch NonLife Insurance system that, supports:

The module ensures calculation of technical provisions (reserves) required for internal and external reporting. The module can calculate:

Premium provisions are calculated on the lowest level of details (cover level).

Moreover, having claims data from the claim handling system, the module calculates technical provisions for:

The Comarch NonLife Insurance solution is able to handle general insurance products for different segments of clients under one solution. The solution supports insurance products for individual clients, self-employed, and business clients (SME and corporate).

Insurance products for individual clients are:

Insurance products for self-employed clients are:

Insurance products for business clients (SME and corporate):

Many insurance products can be sold through various distribution channels. More and more entities, whose essential activity is not related to insurance, offer their own services / products enriched with insurance.

For instance, banks offering loans, credits, credit cards, or mortgages try to sell these with payment protection insurance (known as credit insurance, credit protection insurance, loan repayment insurance). These insurance products are in fact simplified life insurance, however they also cover risks of death, serious illness, accidents, invalidity, incapacity to work and unemployment.

There are also producers and distributors of white and brown goods, which, just like banks, sell goods in credit, so they can offer payment protection insurance. Additionally producers and distributors can offer insurance of extended warranty for the equipment. There are many more possibilities to link goods, products and services with insurance, and the Comarch NonLife Insurance system supports the handling of such insurance offered in various distribution channels.

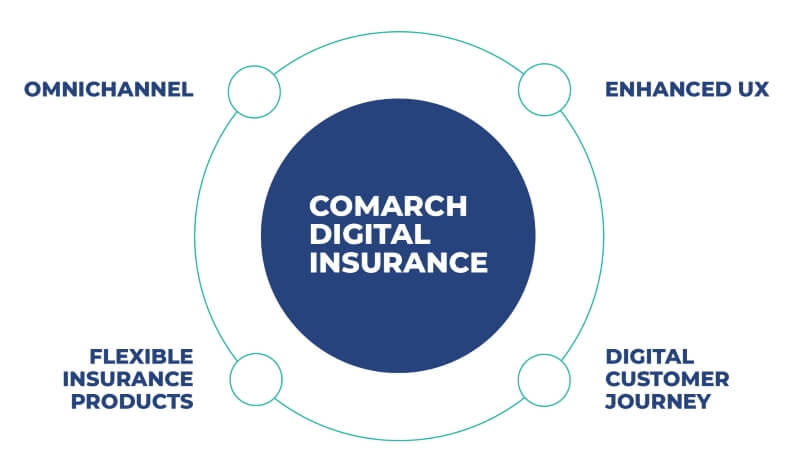

Integrate your software with Comarch Digital Insurance, an omnichannel front-office solution.

It offers features for non-life insurance products such as real estate, vehicle, health, travel, commercial, and others. All tailored to your needs.

Comarch Digital Insurance includes three applications for distributors, business administrators and end customers. The applications are based on one business logic engine.

Manage customer data, create and delegate tasks, get reminders and much more. Plus, digitalize your policy lifecycle, including:

Tell us about your business needs. We will find the perfect solution.