Comarch Digital Insurance – SME InsuranceWin SME clients with offer flexibility and short time-to-market.

Comarch Digital Insurance – SME InsuranceWin SME clients with offer flexibility and short time-to-market.

Digitize quotations, offers, proposals and after-sales services. Win SME clients with offer flexibility and short time-to-market. Comarch Digital Insurance is a front-office software aimed at insurers catering various client types, including SMEs. It automates needs analysis, sales processes and after-sales operations. It supports both life and non-life insurance products.

Find out more about using Comarch Digital Insurance for SME if you wish to…

Let your agents customize insurance products for their clients on the go. Offer various policies, even the most comprehensive ones.

Your product list can include:

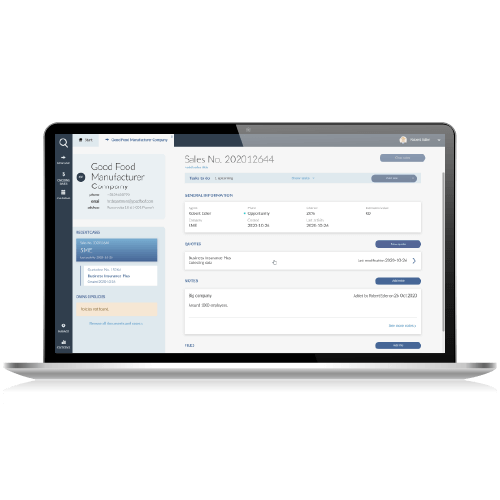

Contact details, company information, important dates – view all relevant client information in one place and forget about lost notes or missed meetings.

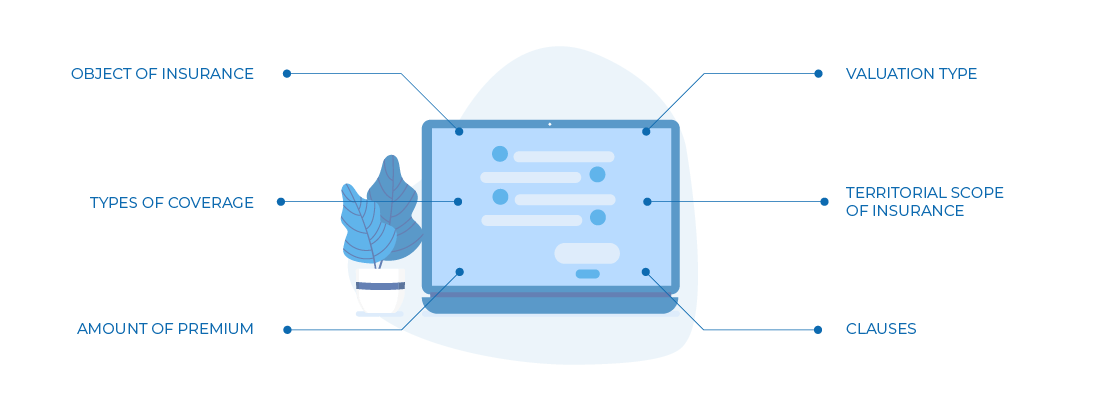

Know about all client’s owned insurance products in seconds. One screen, many policy information:

Let several employees work on one SME insurance sales process. Including tender invitations, offer preparation or acceptance schemes.

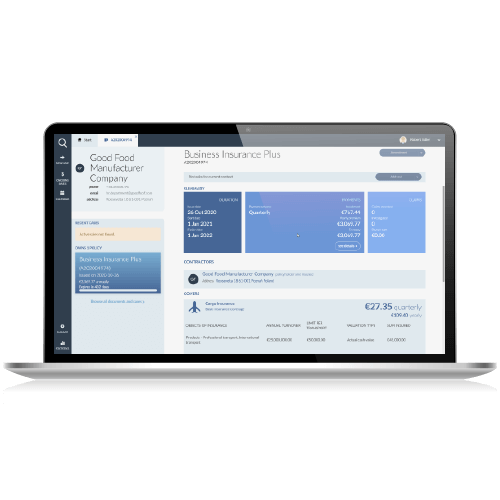

Register claims on existing policies through FNOL reports. Once integrated with the claim management system, the details and status of the claim will always be presented on the policy 360° view.

Use predefined sales reports to analyze data about performed operations. Measure sales goal realization in selected time periods, divided by product and client type. Check sales effectiveness and time. Discover the numbers of prospects reaching each sales process step. For advanced reports, integration with external software is required.

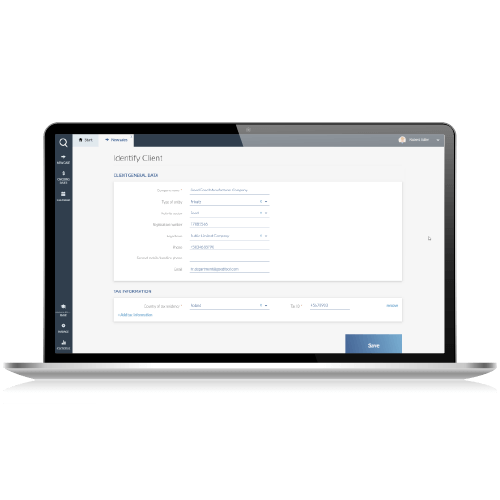

Comarch Digital Insurance for SMEs lets distributors register data. All these information are stored in one place. For the sales process, the user can create a new client account.

…or search for the existing one

A quotation can be started for either existing or new client. Comarch Digital Insurance gives users easy access to client data. The software can identify and correct typos.

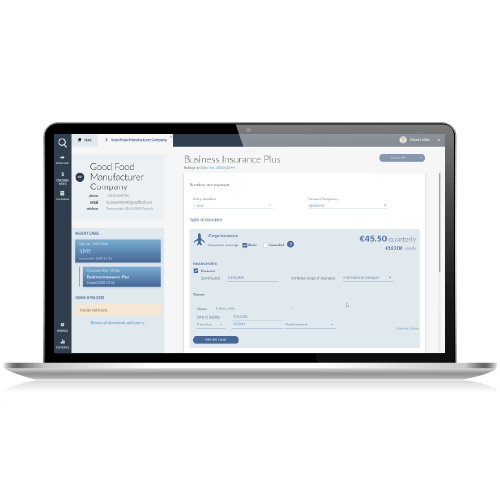

The quotation process collects data on client business activity and claims history to calculate the premium. Agents, brokers or other users can run a full quotation for SME insurance. They can choose the insurance and covers to sell from a predefined product list.

The SME insurance package includes wide insurance coverages, with adjustable insurance clauses, franchises and other parameters.

For each object type, such as building or electronic equipment, users can declare more than one object within a policy.

Our software enables the calculation of insurance premiums in standard and non-standard situations. These can be assessed individually by an authorized user.

Just as in case of other functionalities, premium calculation in Comarch Digital Insurance is flexible.

Variant and premium calculation algorithms can be created by IT specialists, either from Comarch or your in-house IT department.

Create dedicated offers based on previously prepared quotations.

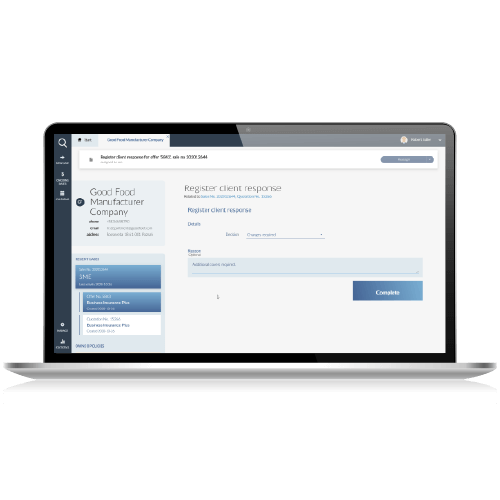

Offers can be easily accepted or rejected. For the rejection scenario, distributors can prepare a new version using the initial quotation.

Go from offer to policy issuance within a few clicks in the acceptance scenario.

Your distributors will be able to register client planned response date and receive reminders connected with it.

A policy can be issued and paid for online. Comarch Digital Insurance for SMEs can be integrated with a variety of payment platforms.

Purchased policies are all displayed in one place. All policy details can be quickly accessed from the policy view.

Distributors like agents, brokers, intermediaries or insurer’s employees all have access to the application with more advanced features.

Business administrator can configure the parameters, business rules, premium calculation, rights, roles in organizational structure, and have the possibility to change or adjust your products in the software if needed.

End-clients who are using their application from time to time will be glad with a wide range of easy-to-use functions and the possibility to buy a policy online.

Tell us about your business needs. We will find the perfect solution.