Comarch Digital Insurance for life insuranceFrom needs analysis to after-sales service: automate your daily tasks and streamline sales

Comarch Digital Insurance for life insuranceFrom needs analysis to after-sales service: automate your daily tasks and streamline sales

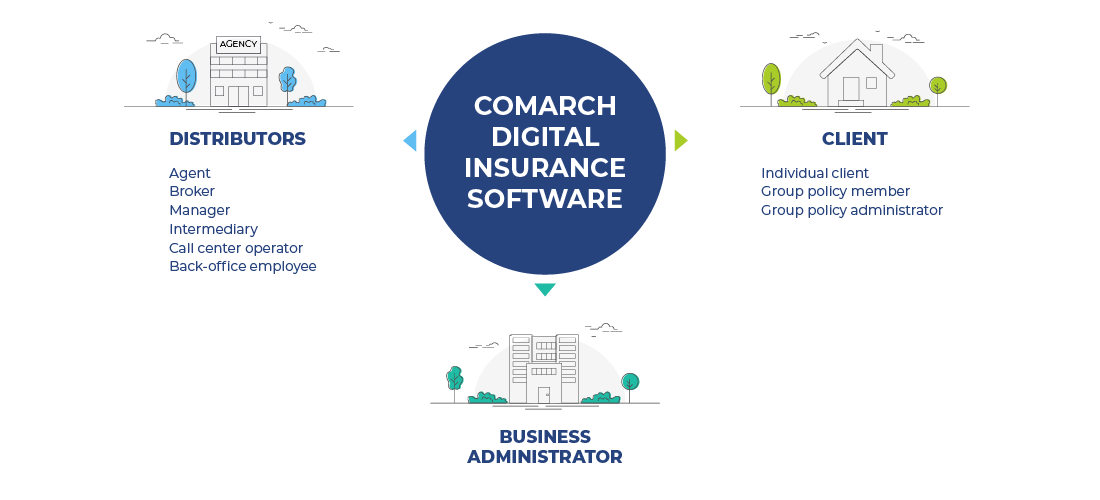

Comarch Digital Insurance is a front-office solution with numerous facilities for: insurance distributors, business administrators and end-clients. It allows you to advance the digital transformation at your company, with particular focus on life insurance. It improves your needs analysis, quotation and issuing policy as well as after sales operations.

Have your distributors run preliminary needs analysis. Define client life quality and find potential areas of purchase interest.

This allows your distributors to select protections and provides the sum of protection according to the recommended areas of interest. With the automatic calculation and estimation of the sum insured, every process will be smooth. The sum of protection can be changed manually too

Give your agents and brokers access to storylines and other marketing materials about policies in one place to easily convince your clients to purchase a life policy

The storyline examples are available in the life insurance software for the agent, and with every client, the agent can choose a storyline that fits the profile best. The examples talk about possible events that might happen where the insurance policy would prove to be beneficial.

Handle various types of sales processes in one software for life insurance agent. Every process can have different steps for different client types.

This allows you not to worry about losing the sales process data. Once started, a sales process can be stopped at any time by the agent and all the entered data will be saved in the client view.

Quickly deliver life insurance quotations, through the automatic data entry from previously completed needs analyses.

The available covers, extra risks or the sum insured can be modified in our software for life insurance agent. The covers include:

You can create offers and proposals once the initial data about the policyholder is in place. These documents can be then printed out or sent directly to the client.

Choose your own number of available variants for life insurance. Each variant can have different scope of covers or sum insured.

All of these can be compared and viewed on one page. The number and details of these variants can always be configured by IT specialists. The parameters of product definition can be managed by business administrators through the Business Administrator Application of Comarch Digital Insurance.

Run underwriting questionnaires for risk assessment as part of life insurance policies.

The scope and number of questions will vary and may include matters of general health condition, occupation, life habits and hobbies. You can run your questionnaires online, send them via email or make printouts for the customers, directly from the software.

What can be the result of the automatic underwriting questionnaire?

With configurable rules, your business administrators will be able to change and adjust the underwriting questionnaire in terms of questions and relations between them.

Process online payments as you please.

Make policy amendments, renewals and terminations in one life insurance software for the agent.

You can create first notice of loss (FNOL) reports, plus add notes and attachments to the processed claim. Every after-sales process started can be easily found in the client and policy view.

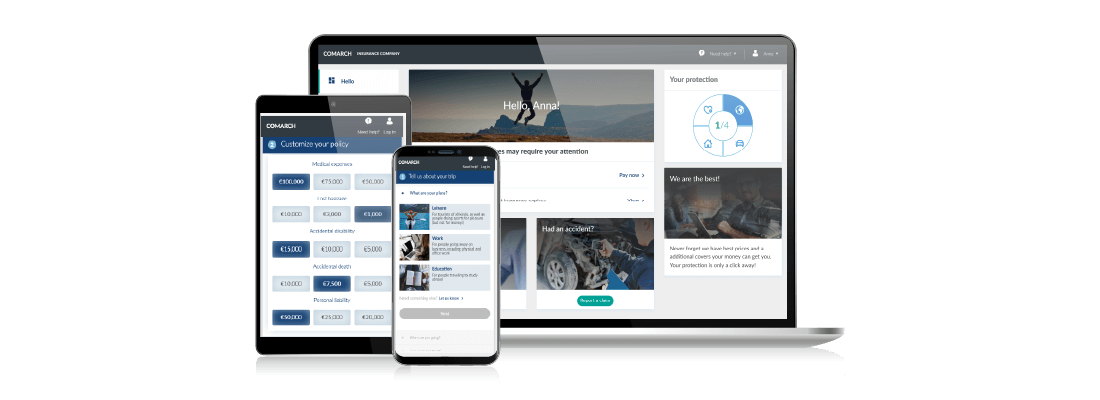

Offer your policyholders the access to a client application, available on various devices

In so doing, you’ll let them:

![]() For our investment and life products, we needed a new tool to support both the pre-sales activities of our distribution network, including needs analysis, simulations and quotation – and the sales processes, ranging from offer preparation through policy issuance to report generation. We also aimed at a comprehensive solution with enhanced user experience, allowing us to stay on top of the upcoming laws such as PRIIPS or IDD.

For our investment and life products, we needed a new tool to support both the pre-sales activities of our distribution network, including needs analysis, simulations and quotation – and the sales processes, ranging from offer preparation through policy issuance to report generation. We also aimed at a comprehensive solution with enhanced user experience, allowing us to stay on top of the upcoming laws such as PRIIPS or IDD.

Georges Biver, Head of Life & Health at AXA Luxembourg

If you also wish to change your legacy system and have comprehensive functionalities to manage all relevant operations in your company, discover Comarch Life Insurance. It handles various life insurance products and allows for an efficient management of all areas of the insurance business, including: product definition, fund management, policy operation and management, finance and accounting reporting, and more.

Distributors like agents, brokers, intermediaries or insurer’s employees all have access to the application with more advanced features.

Business administrator can configure the parameters, business rules, premium calculation, rights, roles in organizational structure, and have the possibility to change or adjust your products in the software if needed.

End-clients who are using their application from time to time will be glad with a wide range of easy-to-use functions and the possibility to buy a policy online.

Tell us about your business needs. We will find the perfect solution.