Insurers today must stand out in terms of offer and costs to get their message across. Every day is a battle for being the most up-to-date and most innovative player. Let us lend you a hand in employing Artificial Intelligence in insurance.

Forecasting sales results, analyzing policy risks, claims management…Creating a solution that draws on AI is achievable for your business too. It can be used for smaller or bigger cases and support selected system functions. Using AI in insurance software will secure your market position for now and the future.

What additional products should be recommended to clients?

How to forecast sales results?

What are the policy risks? How to analyze them quickly and thoroughly?

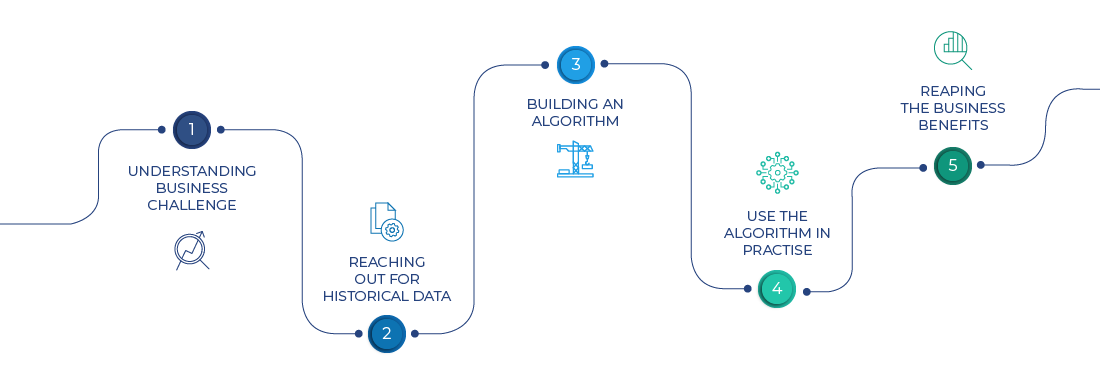

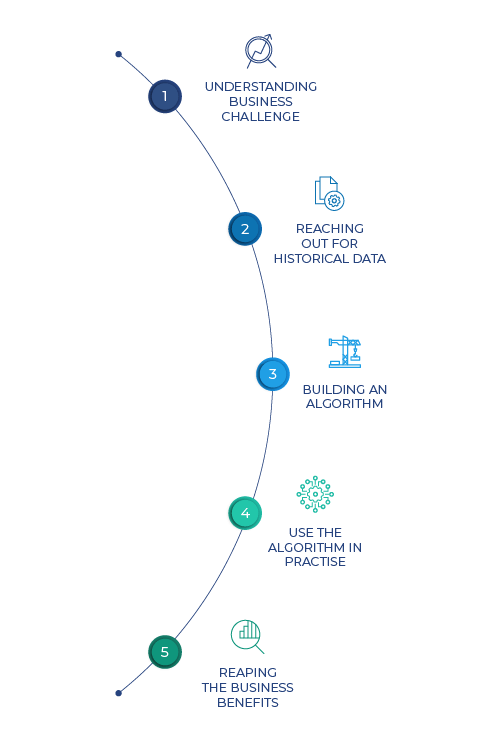

The cooperation with Comarch to work on AI insurance services consists of several steps. Get to know these to understand our approach better.

We see data everywhere, every day. But can you really say you know how to use its potential? Are you able to draw certain conclusions if there’s more than a million of different pieces of information? Here comes the Artificial Intelligence, for which data is the lifeblood. With a close cooperation of IT and business environments we can find the best use of AI insurance services at your company.

It’s important for us to define individual business cases. AI can be used for large data sets or repetitive tasks. This is our starting point for creating AI insurance algorithms and proof-of-concepts for a defined business case.

With insurers having thousands of clients, being able to analyze all their data seems tough. However, much is possible with Artificial Intelligence in insurance. Request classification and assignment, claims recognition for vehicles, and much more. Artificial Intelligence in insurance is not only about speeding up processes. We can use it for an advanced prediction of certain behaviors. And knowing future sales results will give you the leverage you’ve been searching for.

Now that we have defined a business case, we need to reach out for your historical data to build an algorithm based on it.

An Artificial Intelligence model is maturing like a child. The model too must learn by being shown desired behavior examples. Only the way it acquires knowledge is different. We need to train it with data of large amounts and high quality. Without the data we’re unable to train the model, according to which our AI tools will work.

To create the insurance related AI model suited for your company, we will use data you provide. Insurance companies, already have a lot of internal data which can be used. It’s now the matter of quantity and quality which is always individually assessed for a given project. Remember that to make your AI insurance services company-specific, we need to work on your data.

At this stage we’re building an AI model and training it to perform special tasks based on the available data. During the training, patterns are being found and weights of the models are tuned. Training is an iterative process in which all the results are compared. Thanks to a close cooperation with the customer, many valuable models can be prepared.

By comparing results obtained from our models, the quality of the model can be assessed. With the well-trained AI models, our customers can discover patterns or business relations previously unseen. Pointing out data elements most important in the business processes brings invaluable insights to the decision makers.

A trained algorithm is then ready to be incorporated into the software.

The model can be now used in practice. We can equip a system you used so far with extra AI-based functions. These can come with our Comarch Digital Insurance software or other products for insurance companies. AI insurance services are flexible and most of the times can be embedded where you want them to be: in a feature or process.

Artificial Intelligence is now part of your business. It is the time to use its benefits and make it positively influence your income. AI in insurance can be used in many aspects, many of which are measurable. At this stage you can monitor the outcomes of your project. You can answer questions like:

Is policy issuance faster due to AI support in risk analysis?

How well are the sales forecasted with AI insurance services?

How much does AI speeds up the sales and underwriting processes?

As a large IT solutions provider we want to use the best technology internally to smooth or improve processes. Having in-house experience of AI technology gives us additional advantage and proves the concept works.

We had an issue. What we always wanted to know ahead, was if our sales activities are enough. Our business oriented managers needed more advanced information to make some strategic decisions for the future. Spreadsheets were no longer enough.

A solution was found. We’ve built up business cases around our products and are now using AI in our internal CRM solution. Our team created AI algorithm to predict our financial results based on current data registered in CRM. We gave it enough information to run specific forecasts and are now happily using AI elements included into our CRM client’s view.

Tell us about your business needs. We will find the perfect solution.