Facing a legacy system – a real challenge for insurersPoll Results Report from the Thai market

Facing a legacy system – a real challenge for insurersPoll Results Report from the Thai market Life Transformation – P&V Success StoryInsurance Innovators Nordics 2023 – session recording

Life Transformation – P&V Success StoryInsurance Innovators Nordics 2023 – session recording

The modern insurance market poses many challenges for insurance companies: growing customer expectations, strong competitive pressure and a changing business environment require efficiency, which is only possible with the use of modern tools.

Today’s IT systems for insurance must support the work of all users: agents, brokers, business unit employees, claim adjusters, and other back office operators, ensuring service of the highest quality. At the same time, they must provide the customer with immediate access to information and self-service channels, and deliver data to insurers at managerial and analytical levels.

Modern IT solutions for insurance companies support various types of insurance, e.g. life or non-life insurance, and within those types - insurance for individual or commercial customers. All this in one coherent solution, without the need to log in to many tools. Such modularity allows to adjust the solution to the insurer's needs and provides flexibility in creating their own IT architecture.

Modern software for insurance allows for efficient operation of the insurance network. Cooperation in one software facilitates the working of all users: customers, agents, brokers, business unit employees, claim adjusters, and other back office operators. This software supports end-to-end processes of pre-sales, sales, and after-sales. In particular, it enables the analysis of customer needs, making quotations, preparation of an individually tailored offer, issuing an insurance policy, and then reviewing and amending existing conditions, and issuing new policies. Smooth after-sales service regardless of whether it is endorsement, renewal, or complex claim handling is also provided. The IT system collects information and documents in one place, allows for recording and monitoring of all contract events and actions, and intuitively guides through the processes with no need for additional handbooks and procedures. In this way, it supports all users and eases daily work.

The philosophy of putting the customer at the center of every company’s mission, insurance one included, must also be reflected in its IT systems. It means not only focusing the attention of agents and other intermediaries on the customer in order to ensure the highest quality of service, but also enabling the customer to contact the insurer directly and execute insurance quotes, including taking out an insurance policy and making payment. Access to further monitoring and management of ongoing policies allows you to build relationships between the customer and the insurer. A self-service channel for the customer not only reduces service costs, but also creates positive associations and helps build lasting ties, reducing the negative feelings associated with loss events.

Modern insurance software must be flexible and agile - it can be understood in several ways. Firstly: cloud-optimized open architecture and ready-made APIs ensure cooperation with external systems as well as smooth data import and export. Secondly, the modular design allows us to tailor the scope of the solution to the needs of the insurer and flexibly create the architecture of IT systems. Thirdly, parameterization ensures freedom in the creation of the insurers' product offer and allows to minimize time-to-market, which is necessary to ensure competitiveness and continuous business development.

Software for insurance companies is finally a set of tools for efficient business management. It is an opportunity to analyze and manage the work of agents, profitability of insurance products, costs and revenues, etc. These are the elements of Business Intelligence analysis used in insurance software. On top of that, the insurance system can cooperate with dedicated, external BI class tools.

Existing IT solutions for insurance facilitate the fulfilment of legal requirements related to national and international regulations concerning the conduct of insurance business (e.g. IDD and PRIIPS) or the storage of personal data (GDPR). The IT system has to be constantly developed and adapted to the changing business and legal environment. Only regular system update made by a trusted IT service provider guarantees business development and regulatory compliance.

The implementation projects are not easy, especially when you want to modernize your IT landscape and exchange selected part or all existing systems. It is very challenging to not fail with many modules, features and insurance products. The new software and the vendor approach need to meet this expectation – check how COMARCH is doing it!

We are aware that usability of everyday operations is crucial for end-users, thus we focus on the look and feel of business solutions at both the design and implementation stage. Our insurance software solutions are designed to effectively manage the full range of insurance, including life, property and casualty, providing support for all insurer’s activities including the work of sales force and client's service.

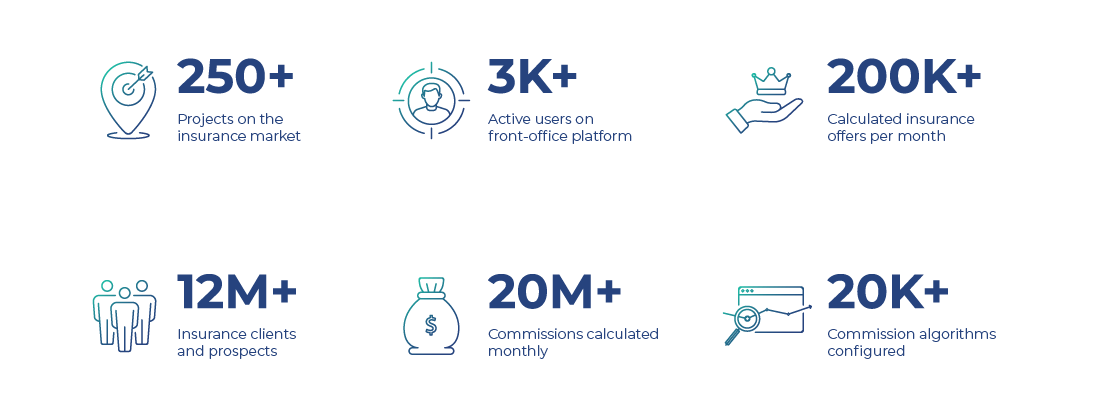

As one of the largest IT suppliers in Europe, Comarch boasts many product lines, a rich collection of competencies and most importantly a large group of satisfied clients. We offer our own pre-designed and dedicated insurance management software. There are a few important characteristics describing our company and insurance implementations:

Because we are thoroughly familiar with our clients’ goals as well as industry trends and technologies, we can efficiently reengineer selected business areas of any financial organization and institution by delivering fine-tuned, customizable tools. They cover insurance processes throughout the whole value chain and are targeted for both internal and external users within multiple activity areas.

Tell us about your business needs. We will find the perfect solution.