P&V's goal is to reinforce its position as reference player in the retail life segment through digital transformation. The Comarch Digital Insurance product was chosen for this purpose because of its broad capabilities.

COMPANY: P&V Group

INDUSTRY: Insurance

PROJECT OBJECTIVE: The digital transformation of P&V Group’s life insurance business aims to reinforce its position as reference player in order to become a market leader in the retail life segment.

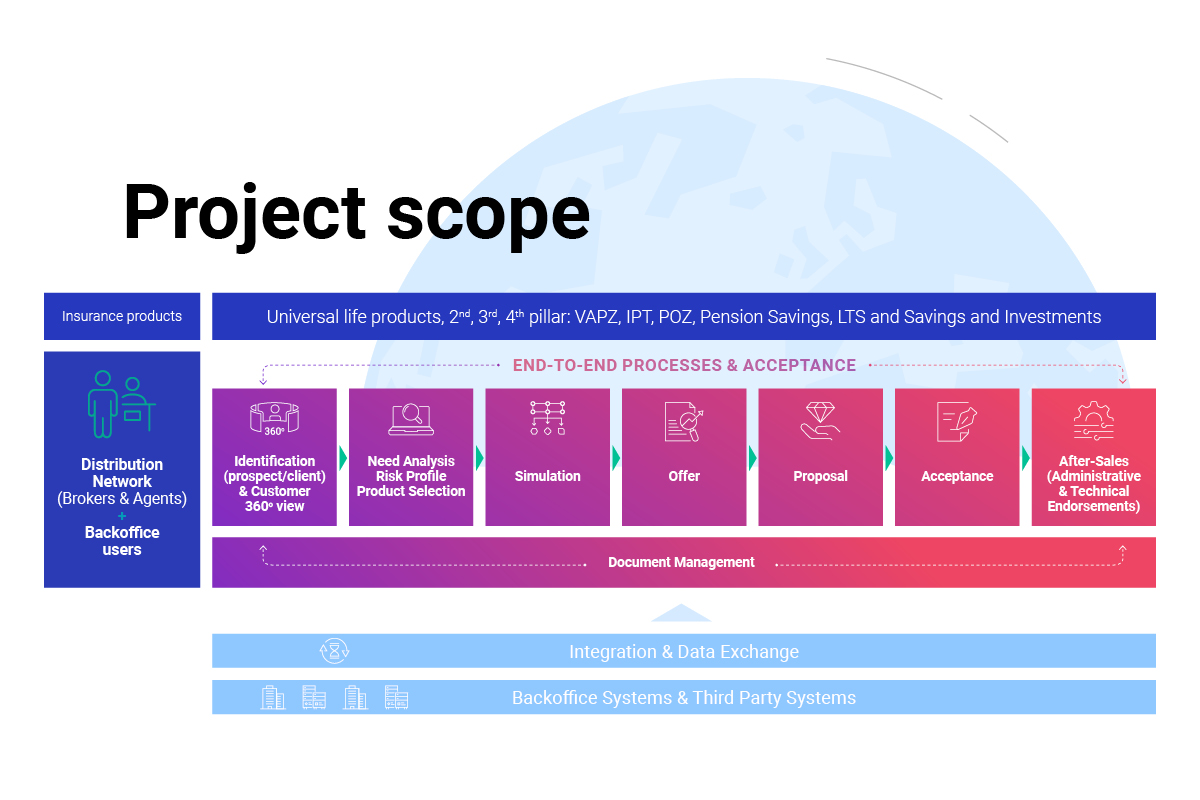

PROJECT SCOPE: Implementation of a comprehensive front-office solution covering pre-sales, new business and after-sales processes for life & pension insurance to speed up client service. It is also a collaborative tool for distributors (brokers, agents) and back-office employees to perform processes end-to-end.

IMPLEMENTED SOLUTION: Comarch Digital Insurance

SOLUTION SUPPLIER: Comarch

PROGRAM DURATION: The program is conducted in an agile way, aiming to deliver business value as quickly as possible. Therefore, the phases lasted no longer than a few months each.

Since 2021, the following features were successfully released:

Future releases will focus on introducing new products and managing the traditional life portfolio.

For this ambitious transformation program, we were looking for a partner that offered the advantages of a package solution, while offering the flexibility to adapt the solution to our specific needs.

PATRICK VAN GEYSTELEN, Director Life & EB at P&V - Vivium

With Comarch Digital Insurance, we provided P&V Group all the necessary features for the transformation of their life insurance landscape in one modern and comprehensive platform.

Comarch and P&V aligned ambitions to deliver a solution that stands out in the Belgian life insurance market. In doing so, we offered P&V the advantages and accelerators of a packaged solution, while demonstrating our flexibility to differentiate and localize the solution for the Belgian market.

WIM VAN WILDERODE, Sales Manager at Comarch

P&V struggled with insufficient IT capacity to run the ambitious life transformation program within own resources. Being aware of the significant functional and technical gaps in most software offered on the market, they were looking for a partner open to co-creating new software capabilities that could easily overcome any shortcomings.

Vastly important to P&V was that they were operating in a highly regulated segment of tax-driven products, with very localized and country-specific requirements. Furthermore, migration of clients and policies portfolios brings a level of uncertainty to the project.

P&V envisioned a strategic life transformation program with an ambitious roadmap, linked to a tight schedule. The implementation based on scrum practices requires flexibility and a close cooperation between Comarch and P&V. Furthermore, we fitted our solution in a complex IT landscape with numerous integrations, including several legacy systems.

TOMASZ KRAJEWSKI, Project Manager at Comarch

Indeed, one of the key success factors of this transformation program was that we defined a long-term roadmap and vision, but we only committed for the first phase. This enabled us to continuously rechallenge our initial ambition and priorities to keep in line with a fast changing world, changing needs and priorities of our partners and clients.

MOUSTAPHA KHARBOUCH, Program Manager at P&V

One of our goals was to be more agile and responsive to the market requirements of life insurance business in Belgium.

We managed to implement a very complex legal change from inception to testing in 3-4 weeks, and were one of the first in the market to adapt to the new 80% rule regulation in our core platform, thanks to the Comarch Digital Insurance (CDI) platform.

JEROEN SPINOY, Director Business Development Life & EB at P&V – Vivium

P&V’s ambition is to regain the position of reference in the second pillar for the self-employed, become a competitive player for risk coverages, the third and the fourth pillar. Therefore, we aim to leverage our focus on our existing channels, where VIVIUM focuses on the self-employed and P&V focuses on individuals through independent brokers and tied agents. With this program we also anticipate introducing new products and services.

JEROEN SPINOY, Director Business Development Life & EB at P&V – Vivium

In the new platform we are able to manage everything related to universal life and unit linked products in the different pillars (2nd, 3rd, 4th).

MOUSTAPHA KHARBOUCH, Program Manager at P&V Group

Comarch Digital Insurance is an omnichannel front-office software for your clients and distributors with many possibilities:

P&V is a cooperative insurance company that provides Life, Non-Life and Employee Benefits insurances to a wide range of clients. With brands such as P&V, Vivium and Arces, the P&V Group operates in a multi-brand and multi-distribution channel model. P&V focuses exclusively on the Belgian market and secures a strong market position as the 7th largest insurance company.

Founded in 1993 in Kraków, Poland, Comarch prides itself on being one of the leading software houses in Europe, with several thousand employees worldwide and thousands of successful projects carried out for the largest international brands.

With many years of experience in the industry, Comarch Financial Services, a business sector within the Comarch Capital Group, specializes in developing sophisticated software and IT systems for major financial institutions in banking, insurance and capital markets.

Our expertise has gained worldwide recognition and a significant portfolio of clients among insurers, banks, mutual and pension funds, brokerage houses and asset management companies in more than 30 countries.

Tell us about your business needs. We will find the perfect solution.