Watch the video interview and see how TMBThanachart (ttb) became one of Thailand's most innovative banks

Watch the video interview and see how TMBThanachart (ttb) became one of Thailand's most innovative banks

The goal of the project was to provide the bank with a completely new system built on the cutting edge technologies and the most recent IT trends. The platform was to be fast and efficient, but also open to expansion and integration with external partners/Fintech. Moreover, the solution was supposed to be both user-friendly and intuitive. User experience was put in the first place.

An additional challenge was to provide an application that functionally covers the old system having been developed for over 10 years. The Bank expected a solution that would incorporate all existing functionalities, extended by new technologies, such as artificial intelligence.

“The bank was following the idea: the client in the focus and expecting the system to be simple and convenient to use.”

Roman Bobrowski, Project Manager

Another challenge of the project was a short implementation time, which could under no condition be exceeded. The bank was during merger with Thanachart bank and the date of launching the new system was determined in advance by the date of clients’ migration of the acquired bank.

“It was difficult to adapt many CCB product processes to those already existing in the bank. Developing the solution required the full involvement of teams from both sides.”

Jakub Cieślewicz, Product Manager

At the very beginning of the project, another challenge emerged – the COVID-19 pandemic. The developed model of co-operation was no longer valid. Given the highest priority, the situation required full flexibility, efficiency and quick non-standard decisions. The quickly changing situation in the world could not influence the implementation of the new platform.

“We were confident in our value. As Comarch we have many years of experience in bank mergers in our home market. We knew how important was the task entrusted to us. We knew from the very beginning that the go-live date had the highest priority.”

Roman Bobrowski, Project Manager

Learn more about Comarch Corporate Banking

A lot of banks operating in Thailand use many fragmented back-end systems. This means that a client who wants to use transactional banking and then move on to trade financing often needs to log on to two separate applications. Comarch Corporate Banking covers many types of products and services within one platform. The client has easy and uniform access to all business functionalities, regardless of the back-office of the systems providing data. This makes the performance of everyday activities requiring the use of many products offered by the bank simple and intuitive. The open architecture of the system allows easy integration with Fintech and extension of the on-line banking functionality with additional functionalities, creating a business clients ecosystem.

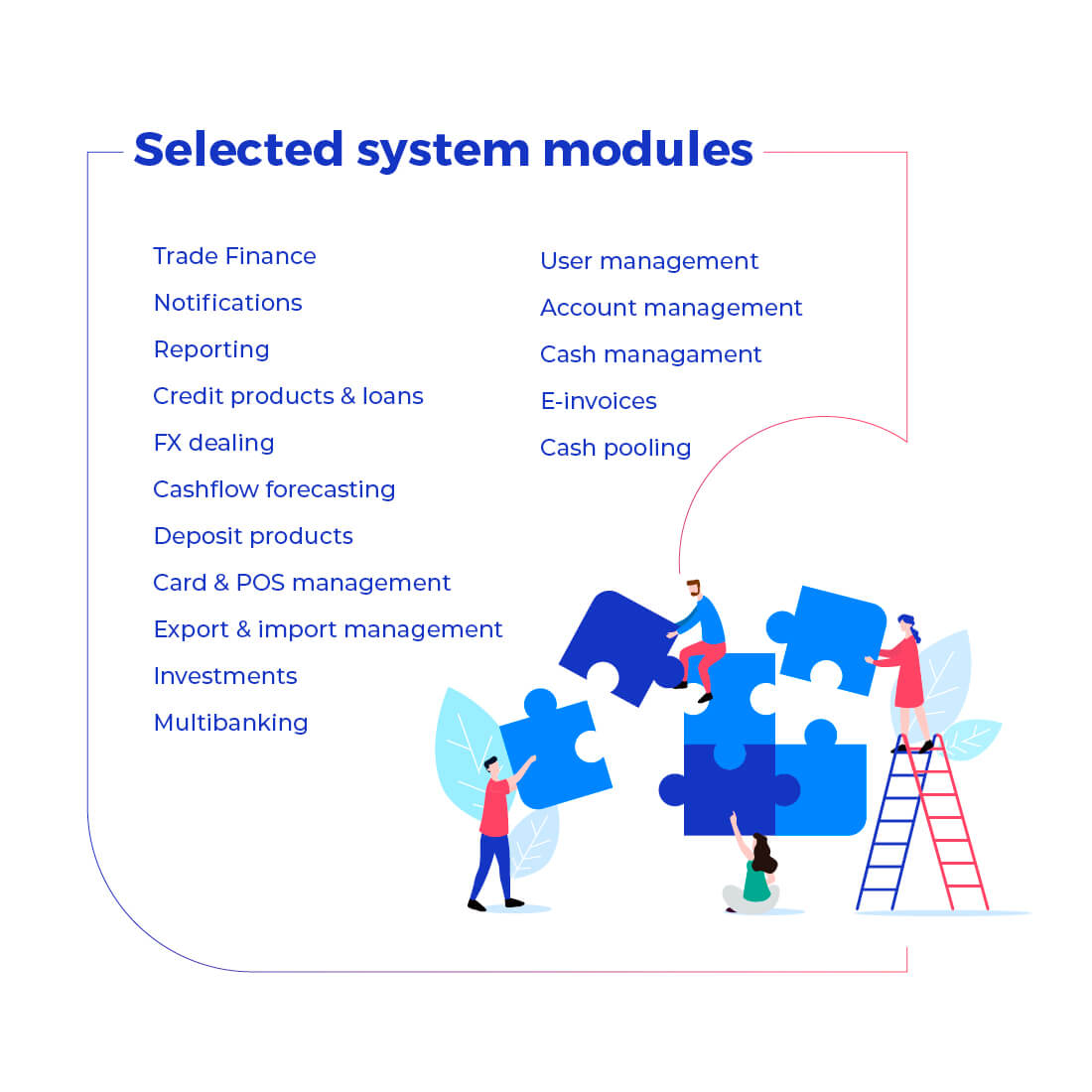

Thanks to Comarch Corporate Banking modular architecture the selected range of functionalities was adapted, implemented and made available to TMBThanachart’s clients in less than 9 months. They included mainly advanced corporate banking. We have opted for Agile.

“Without an agile approach, we would not have been able to launch the system in such a short time. As Comarch we know Agile, we can use it not only for manufacturing but also during implementation. From the very beginning, we were convinced that this approach would let us achieve our goal. Thanks to our knowledge and experience in using agile methodologies, we have been able to introduce Agile into the whole process, also on the side of the Bank, which has joined us in this.”

Roman Bobrowski, Project Manager

The implemented platform is a product version of the Comarch Corporate Banking application – designed and manufactured with business and corporate clients and their needs in mind. The system is a completely new platform, built from scratch using the latest technological trends such as Red Hat OpenShift, Kubernetes. TMBThanachart, by opting for a license model of the platform maintenance, has been granted permanent access to technological upgrades, which in subsequent releases will translate into a transition to a micro service architecture and will allow for unlimited system scaling

Thanks to Comarch Corporate Banking, TMBThanachart can offer their clients a wide range of products and services tailored to their needs. The implemented platform reduces traditional banking costs and provides business clients with the possibility to follow-up their financial situation in real time 24/7. Short implementation period and successful go-live launch will allow the bank to migrate Thanachart clients to the new system and to on-board them in the most modern on-line banking platform on the market. What is most important, the implementation of Comarch Corporate Banking has strengthened TMBThanachart’s reputation as one of the most innovative banks in Thailand, that sets the direction of digital transformation.

Comarch and TTB won Best Digital Transformation Implementation at Thailand Awards 2021, a prestigious competition run by The Asian Banker. This award program draws attention to the most valuable solutions and implementations in order to recommend institutions that deliver the highest achievements.

The jury appreciated the project carried out by Comarch for TMB Thanachart Bank regarding the implementation of the Comarch Corporate Banking (CCB) system launched under the TTB Business ONE brand. The Comarch transaction system includes mobile and desktop applications supporting both corporate and SME customers.

ING’s Comarch Corporate Banking software implementation was named world-best integrated corporate banking site 2019 by Global Finance – for providing exceptional business banking capabilities, combining multiple products and services within a single platform, based on IT tools developed by Comarch.

The solution is available on desktop and mobile devices, where it offers unique and personalized user experience.

Tell us about your business needs. We will find the perfect solution.