Expanding their international footprint, Prudential’s objective was to streamline the management of an extensive, multi-level sales network structure. This included supporting the entire salesperson life cycle, from onboarding, training, authorization up to offboarding, building powerful compensation schemes, defining advanced calculation algorithms, and generating detailed settlement data and documentation.

THE PRUDENTIAL ASSURANCE COMPANY LIMITED POLAND

Insurance

Greenfield project – implementation of the solution that handles all complex commissions for the whole sales network

Comarch Commission & Incentive

Comarch

Q1 2012-Q1 2014

During the project implementation, Prudential kept developing their commission policy, therefore Comarch’s team had to respond quickly to numerous changes being made, including the introduction of complex mechanisms governing deferred commissions.

Later on, the main project was extended to a new distribution channel – bancassurance. Ultimately, the implemented solution was separated from Prudential’s core life insurance system, thus becoming standalone. The next step was to integrate the solution with the new core system – which was not a small task, but went deftly and smoothly.

We knew the system had to cope with complex calculations and a large number of users. The strength of our company is determined by our agents - we wanted technology to help us make sure they are satisfied with the conditions we give them and properly rewarded for their hard work.

Mateusz Wiktor, IT Application Maintenance Manager, Prudential

The main requirement for the system was to be highly flexible and scalable. As a large insurance group entering Poland, Prudential wanted to be able to react quickly and effectively to changing market conditions, a growing sales network and a rapid increase in the number of customers. The role of a commission system supporting the management of the said network is hard to overstate here.

Rafał Kwarciany, Project Manager, Comarch

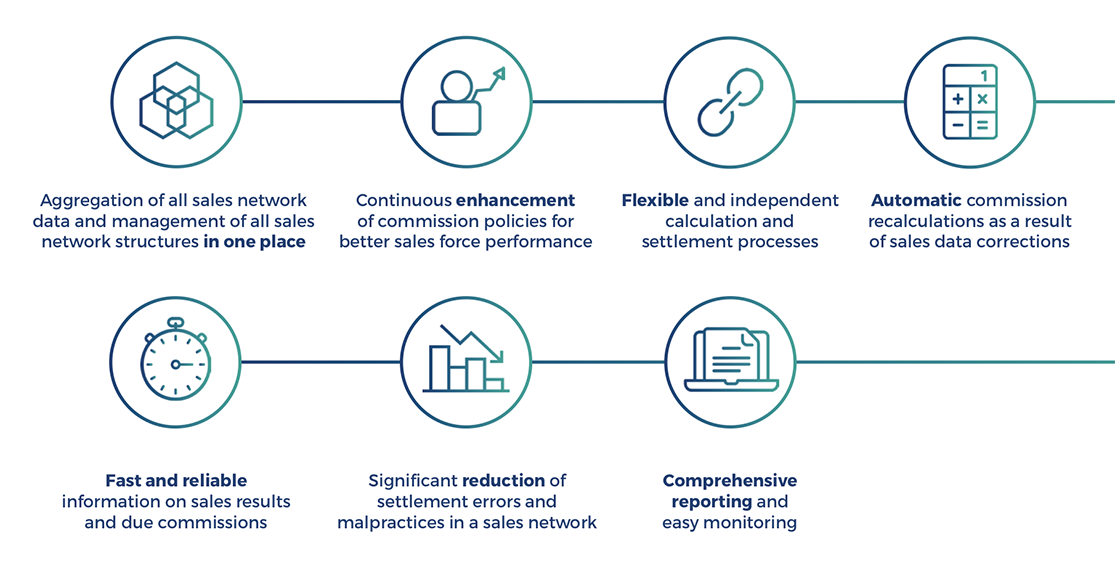

Prudential now has one, coherent and fully configurable system for commission calculations, with agents directly accessing their commission and settlement data, and managers being able to verify the performance of their teams. Although the insurer is in a phase of continuous growth and the volume of data to be handled is constantly increasing, the solution does the job well and there are no performance problems.

The system ensures secure data access thanks to integration with Comarch Identity and Access Management system. Comarch Commission & Incentive is a fully and easily configurable system, no expert assistance is needed.

Prudential wanted their commission policy to be attractive and understandable for the agent network on one hand, and accurate enough to allow for a precise analysis of the commissions paid – on the other. This, combined with parallel development process of Prudential’s sales system and necessary updates of the commission policy that followed, makes for a complete picture of the challenge that awaited us. In a large part, we have risen to the occasion thanks to Comarch Commission & Incentive flexibility.

Rafał Kwarciany, Project Manager, Comarch

Comarch Commission & Incentive is a flexible solution that allows Prudential to configure calculation algorithms by their own staff. Comarch configured only the model commission policy, the remaining adjustments were made by client’s employees after a short training. Currently, all changes in calculations are performed by the client without Comarch’s participation.

Rafał Kwarciany, Project Manager, Comarch

The system has been operating with virtually no problems for years. Business requirements regarding the commission policy are implemented instantly by ourselves, which is very important in our business. Agents are satisfied with the system and canview the calculated commissions on the agent’s portal on an ongoing basis. The financial operations department also appreciates the work with the system thanks to automatic commission re-calculations and extensive reporting capabilities.

Mateusz Wiktor, IT Application Maintenance Manager, Prudential

The solution supports incentive compensation planning and sales network management in insurance companies, banks and other financial institutions. The system functionality has evolved from a commission settlement application to a modern ICM (Incentive Compensation Management) platform, supporting management and communication of sales network via agent portal. Gartner’s analysts in their report MarketScope for Insurance Incentive Compensation Management recognized the system as one of 13 most outstanding global IT solutions in the area of commission calculations and settlements.

Prudential has operated in Poland since March 2013. The company is part of a British insurance group founded in 1848 and present in Poland from 1927 to 1939. Prudential offers solutions that provide insurance protection combined with saving for any purpose, and develops its product offer by introducing a number of additional covers providing financial security to customers, e.g. in the event of critical illness or serious injury.

Prudential currently cooperates with about a thousand exclusive representatives and over a thousand representatives working for multiagencies. Prudential’s simple life insurance is also available for selected customers of Orange and Play mobile networks. Prudential exclusive representatives work in a network of 22 branches and several agencies in smaller towns. The company focuses on the development of its network and wants to enlist about three thousand people as business partners.

Tell us about your business needs. We will find the perfect solution.