Comarch Loan Origination for MortgagesAutomate mortgage sales. Shorten your time-to-yes

Comarch Loan Origination for MortgagesAutomate mortgage sales. Shorten your time-to-yes

Comarch Loan Origination allows for a significant reduction of both time needed to grant a mortgage, and complexity of the process itself. Mortgage simulation, customer analysis, decision-making or fund disbursement... all of these, and more, are automated in our system. What it means is fewer errors. Fewer headaches. And – less work.

Efficient processes

Rely on automated processing that allows you to speed up mortgage origination including borrower verification, decision making and underwriting. Surprise your customers with a short time-to-money and bring smiles to their faces

Multichannel-ready

Let your customers submit applications online, arrange details in your branch, then sign documents online – make their journey seamless, all thanks to an open API

Paperless flow

Go truly paperless by keeping all digitized documents in a central repository. Let the mortgage origination software automatically generate document checklists and bank documents (i.e. European Standardized Information Sheet) for your customers

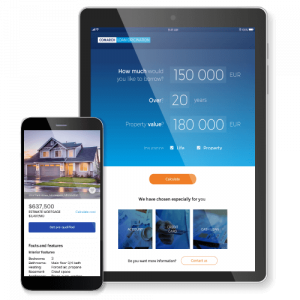

Advanced option simulator

Provide your customers with a simulator of mortgage options to choose from. Let the customers fine-tune your solution to fit their needs

User-friendliness

Take advantage of the embedded training mode allowing mortgage advisors to get a grasp of the system quickly. Forget ugly interfaces: use parts of the mortgage origination software as a presentation tool for customers

Reduced risk of error

Take advantage of automated verifications and decisions. Reduce manual processing and re-routing cases that miss important information

No more organizational walls

Let mortgage advisors, decision makers or operations officers cooperate smoothly with each other via communication tools embedded in the system

Better cooperation with real estate experts and notaries

Make it easier for your employees to ask for expert valuation or request a notary deed by using dedicated expert/notary search and mailing tool

Easy collateral definition

Define collaterals for specific mortgage loans and register collateral data for each application. Sync the data with available databases, or retrieve it from the bases as you please. Single data entry principle applies

Sales volume monitoring

Easily monitor sales efficiency and structure using management dashboards. No more digging for spreadsheets in data warehouses

Cross-sell support

Combine different products in one system: mortgages, refinancing loans, bullet loans, bridge loans, and more. Keep mortgage advisors aware about cross-sell opportunities for credit/debit cards, insurance or other related products

Regulatory compliance

Stay Mortgage Credit Directive compliant, automatically calculate APRC and generate documentation according to the ESIS standard. Edit processes or documents via the business administration module and be ready whenever laws change

Cost reduction

Enable business persons with no tech background to make changes in the system, and in so doing get shorter time-to-market and lower costs

Easy integration via API

Retrieve data from internal or third party databases without the need of double data entry – making life of a mortgage specialist easier

Modular structure

Benefit from a modular structure that supports each step of the mortgage origination process. It allows you to implement the solution in stages

Experienced team

Rely on Comarch’s wide experience with building mortgage origination software for different clients worldwide

Read more about Comarch Loan Origination modules

Check out our solution for SME loans

Read about what to focus on when looking for a mortgage software

Promote your customer-first approach by providing your customers with the augmented reality tool that makes the process of searching for their dream house easier. Comarch AR Loans – Home Finder is a mobile application that allows users to find their house with the help of Augmented Reality and easily apply for a mortgage. The application combines the concepts of marketplace and non-banking services offered by financial institutions to retail and SME customers.

Tell us about your business needs. We will find the perfect solution.