Factoring During the Economic Slowdown – Q2 2023 in Poland

- Published

- 3 min reading

The Polish Factors Association (PZF) has just announced the latest data on the state of the factoring industry. The Q2 of 2023 showed that factoring maintained an upward trend, despite the apparent economic slowdown.

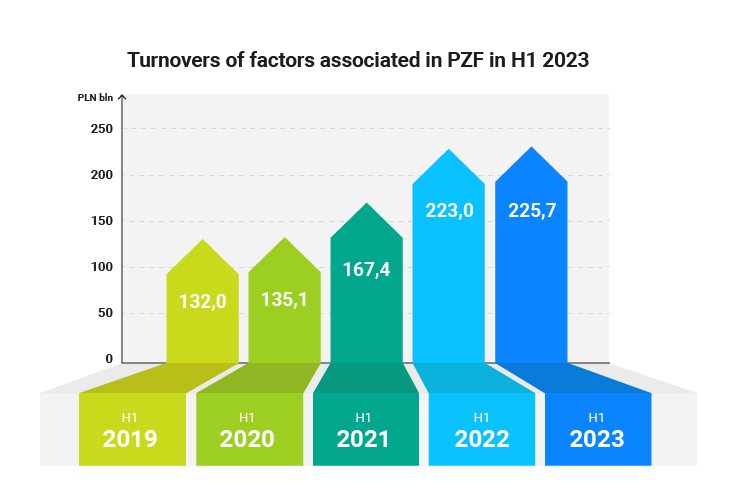

The turnover increase of 1.2% that was recorded by factors associated in PZF may not be as spectacular as the increases in the previous year, however, as the data show, factoring comes out unscathed here. The main reason for the slowdown in turnover growth is the decrease in the value of financed invoices and the higher cost of financing due to high interest rates.

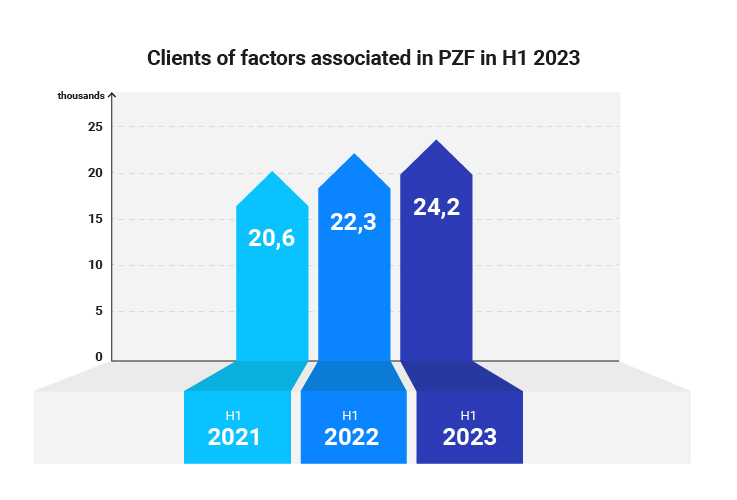

The number of clients served by factoring companies associated in the Polish Factors Association increased to 24,200 – almost 2 thousand more than in the first half of 2022.

Entrepreneurs using factoring provided financing for 12.7 million invoices with a total value of PLN 225.7 billion.

Entrepreneurs using factoring provided financing for 12.7 million invoices with a total value of PLN 225.7 billion.

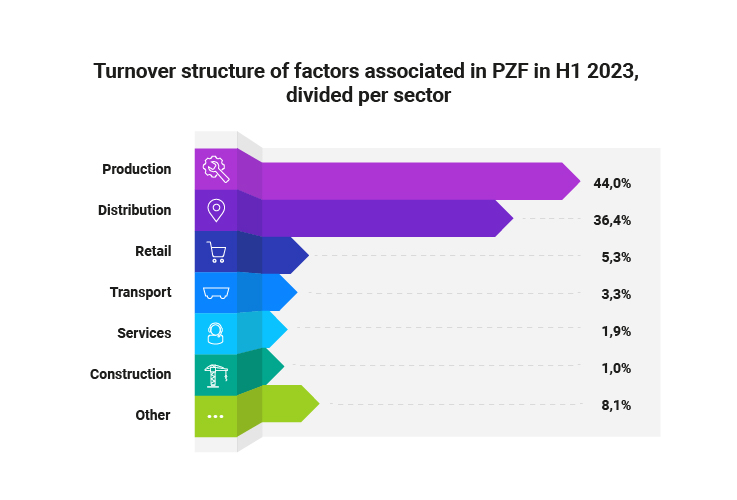

When we look at the turnover by sector, we will notice that factoring is most often used by production and distribution companies. This division into sectors has been maintained for several years and it is the companies from these sectors that are the driving force of factoring, accounting for 80.4% of the entire factoring market.

It is certainly pleasing that increasingly more factoring companies are paying attention to companies from the micro segment and are preparing special offerings for this segment in Poland. It is worth noting that so far micro-segment companies have been bound only to traditional forms of financing, such as an overdraft. Activation of the micro sector will make it possible to maintain the current upward trend in the coming quarters.

Source: Polish Factors Association